FourKites research of late has been largely focused on the shipper and facility operator side. This week, we delve into the world of carriers, where headline after headline details the decline of the commercial trucking market, and the impending “peak disruption” that some industry experts expect over the next few months.

In examining how various carriers are faring throughout this pandemic, we aggregated millions of loads across more than 2,000 carriers in the US FourKites network. We broke them into three groups – small, medium and large – based on their volume of tracked loads between January and April 2020.

So which carriers will thrive? Some have said that it comes down to what’s in their truck – that those hauling goods deemed essential will win over all others. That is part of it, but it’s also about scale. What we found was a clear distinction in carrier load volume growth based on the size of the carrier. In short, we’re already starting to see indications of a market shift in which larger carriers are getting even bigger at the expense of the smaller carriers.

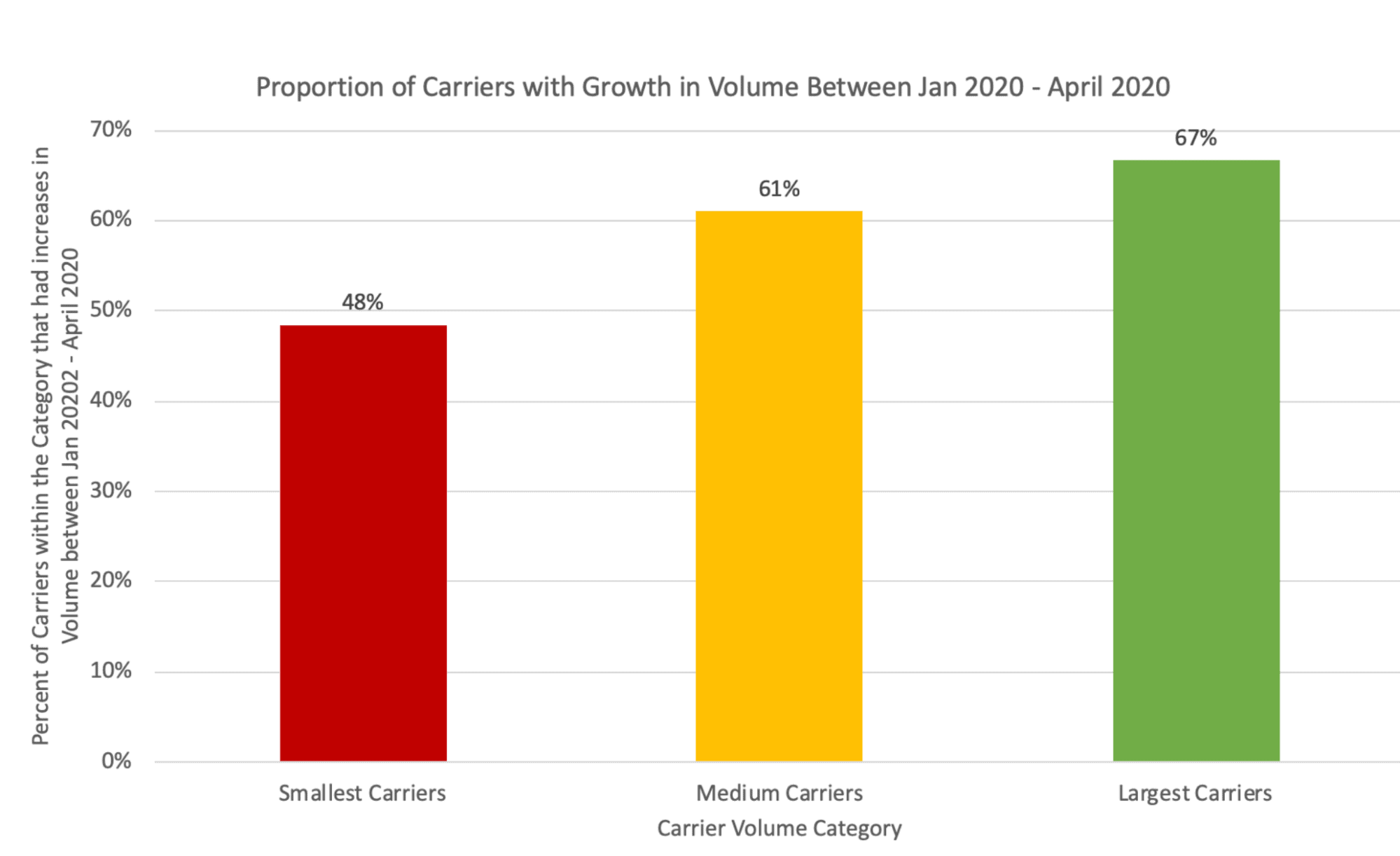

The data show that while 67% of large carriers have seen increased volume over the last five months, only 48% of small carriers have witnessed a similar increase.

The data show that while 67% of large carriers have seen increased volume over the last five months, only 48% of small carriers have witnessed a similar increase.

This speaks to the advantages of size and scale. As the pandemic rages on, we’re seeing that larger carriers – which have made larger investments in technology and have better crisis response mechanisms in place – are able to remain nimble through market fluctuations and take on more volume. From a financial perspective, large carriers tend to have the lowest rates, so when times are tight, shippers will naturally gravitate to the best price.

(It may be no coincidence that even while freight volume continues to drop, carriers of all sizes in the FourKites network have continued to grow. FourKites freight volume over the course of 2020 thus far has increased by nearly 5%.)

Total FourKites TL truck volume, Jan-Apr 2020

Another advantage for large carriers can be found in the loads they’re hauling. Larger carriers have a more diversified customer base, carrying loads across many different industries. By contrast, smaller carriers tend to be more dependent on specific routes and individual customers. When those customers aren’t shipping as many goods, independent carriers are more vulnerable than their bigger counterparts.

In looking at these market fluctuations from the perspective of overall carrier growth, we looked at increases in aggregate carrier volume since the beginning of 2020. Across all carriers, there was a 3.5% overall increase in freight volume, but that growth wasn’t split evenly, with large carriers again coming out on top. Smaller carriers logged a 2% uptick, while the largest carriers in the group showed 5% growth over the same time frame.

Whether these growth trends continue remains to be seen. Until recently, the smaller carriers benefited from a thriving economy. However, the weak rates and excess capacity that the industry experienced in the past year have wreaked havoc on the carrier market – a situation only exacerbated by the current pandemic. As economic activity continues to contract, escalating competition for loads, those carriers with economies of scale and greater technological sophistication will likely continue to earn greater proportions of the nation’s freight shipments.