We are in a pivot moment for the supply chain. After nearly two years of continuous supply chain disruptions and Covid-related lockdowns in China and elsewhere, shipment volume is finally on the rise. Volume at the Port of Shanghai has increased since mid-May, with the 14-day average ocean shipment volume now up 5% compared to March 12. Compared to the same day in March, volume at other Chinese ports has remained strong, with the Port of Shenzhen up 35% and the Port of Ningbo-Zhoushan up 23%.

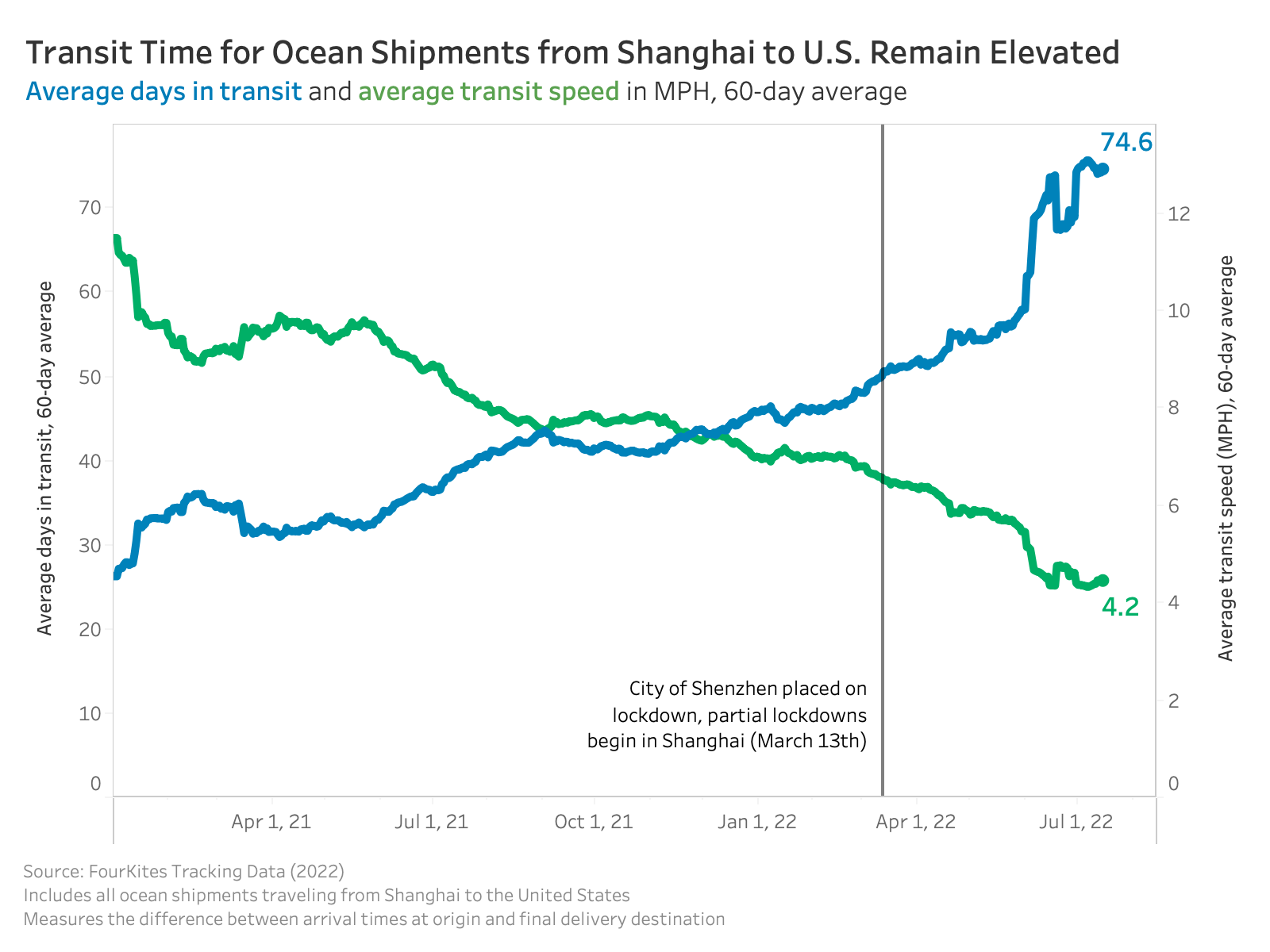

This is felt in the U.S. as exports from China are almost fully recovered from pre-lockdown volumes. The 60-day average transit time for shipments traveling from Shanghai to the U.S. has doubled since mid-March — it is now nearly 75 days, an increase of 49%. Dwell times for export shipments for Chinese ports has also shown some signs of recovery. The 14-day average ocean dwell time for export shipments tracked by FourKites is now slightly more than 7 days, down 18% from the high seen earlier in June.

FourKites also tracked recovery in Shanghai over-the-road and rail/intermodal shipment volume. The 14-day average shipment volume for loads being delivered to Shanghai is now down 38% compared to March 12th, but has also declined 25% over the past week.

The trends reflect an increase of shipments flowing into the U.S., and not just to Los Angeles. We are witnessing record-high shipments to the Port of Savannah, as some of the major shippers are avoiding long waits at certain West Coast ports and sending shipments to alternate ports in the east and south.

I expect rates will continue to tighten over the next 3-4 months as we run into peak season. Over time, this will balance itself out as ports start clearing. But right now, we’re seeing fewer days to clear shipments on the East Coast, which means shippers will have more capacity for inland moves.

Finally, Covid showed suppliers that it’s a safe bet to manufacture in multiple countries, not just in one. Instead of relying only on China, for example, other global supply hotspots like Mexico or Latin America will see increased volume as multi-sourcing will become a hedge against the next global disruption.

Expect shippers to take the same approach: Why not use multiple ports instead of just one? That way, if another major disruption happens, the hold-up will not be as prolonged. Flexibility is key. Every player on the supply chain is angling for alternatives right now to make sure what happened in 2020 does not become the playbook the next time infections overwhelm the population.