Anyone who’s ever hosted Thanksgiving knows that the holiday requires planning. From building your grocery list to brining your bird, it’s not an occasion when you can just “wing it”. (Pun absolutely intended.)

Thankfully, food and beverage suppliers have been planning with their retail partners, as well – building up inventory well ahead of the holiday to ensure hungry Americans can go full “feast mode” from sea to shining sea. But good planning is only one factor in the complex food and beverage supply chain. What about prices, shipping, and other variables that could contribute to a tumultuous Turkey Day?

While we can’t guarantee that the holiday will be stress-free, most signs suggest that Thanksgiving 2022 will avoid most of the supply-chain-related headaches we experienced the last two years. Here’s what to expect, and what to watch, going into America’s tastiest holiday.

The pandemic’s unique challenges resulted in shocks and shortages across multiple industries, straining supply chains from end to end. The food and beverage industry was not spared.

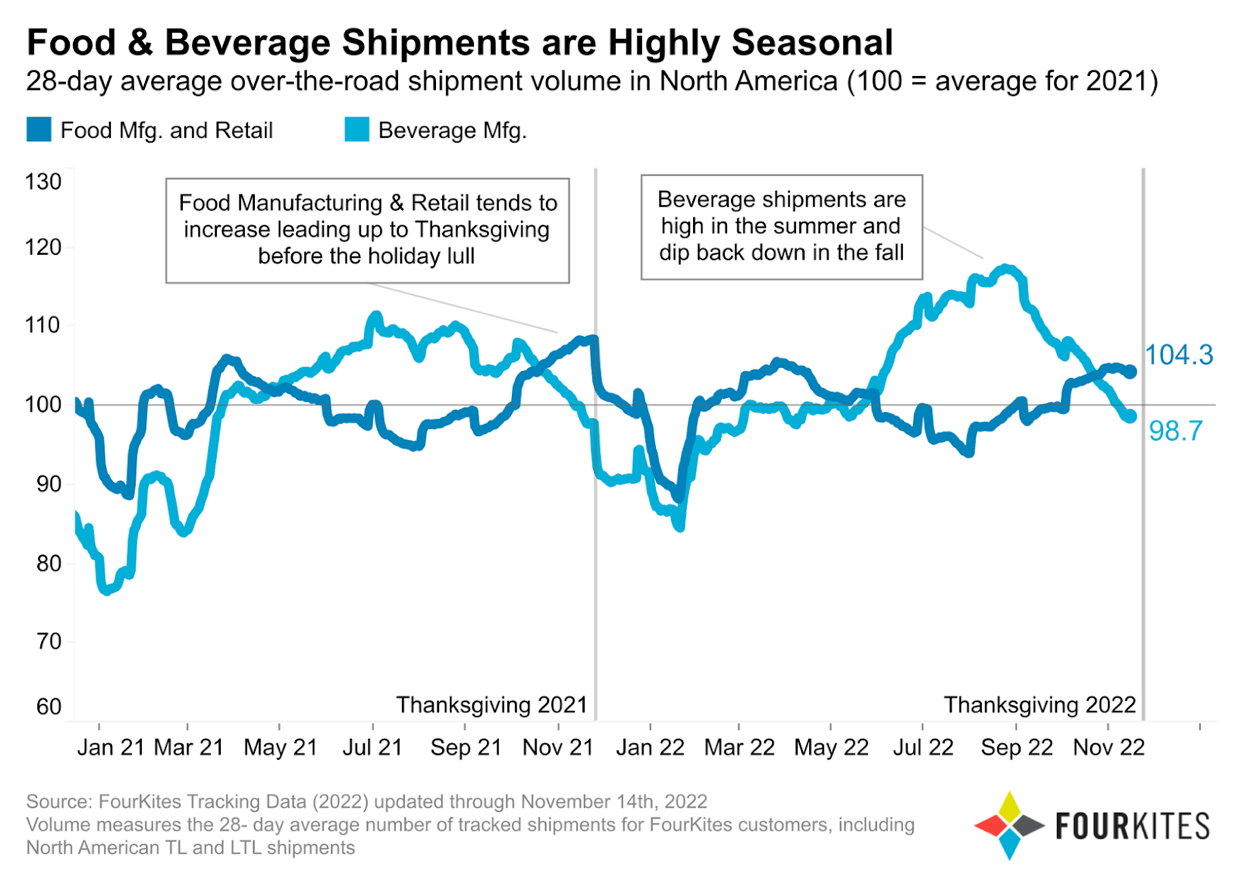

As a result, food and beverage suppliers have wisely begun to build up inventory ahead of time. Food manufacturing shipments typically reach a peak just before Thanksgiving, before hitting a holiday lull — and in 2022, the 28-day average shipment volume for food manufacturing shipments was 9% higher than the yearly average for 2021.

Of course, certain markets may have challenges based on regional deficiencies, ordering patterns, or supply availability. There may also be some degree of product rationalization, given the current economic climate. But overall, we should expect our grocery stores — and our bellies — to be fully stocked.

During the pandemic, costs skyrocketed up and down the supply chain. Labor shortages were widespread, pushing up labor costs. Logistics costs were also astronomical, both for ocean and over-the-road transport as well as for warehousing. And high inflation earlier this year added even more stress for producers and consumers alike.

But recent months have been marked by swift economic softening. The labor market has seen a dramatic shift and consumer demand has slumped, which has cooled off inflation. It’s unlikely that this Thanksgiving meal will be cheaper than last year’s, but overall decreased volatility is welcome news for producers, shippers and consumers.

Suppliers aren’t the only player in the supply chain who’ve been planning; shippers have been preparing for peak season, as well. In stark contrast to the drama of the past two years, we do not expect to see major shipping bottlenecks, either over the road or on the ocean. And truck pricing has dropped dramatically – which should benefit producers and consumers alike this holiday season.

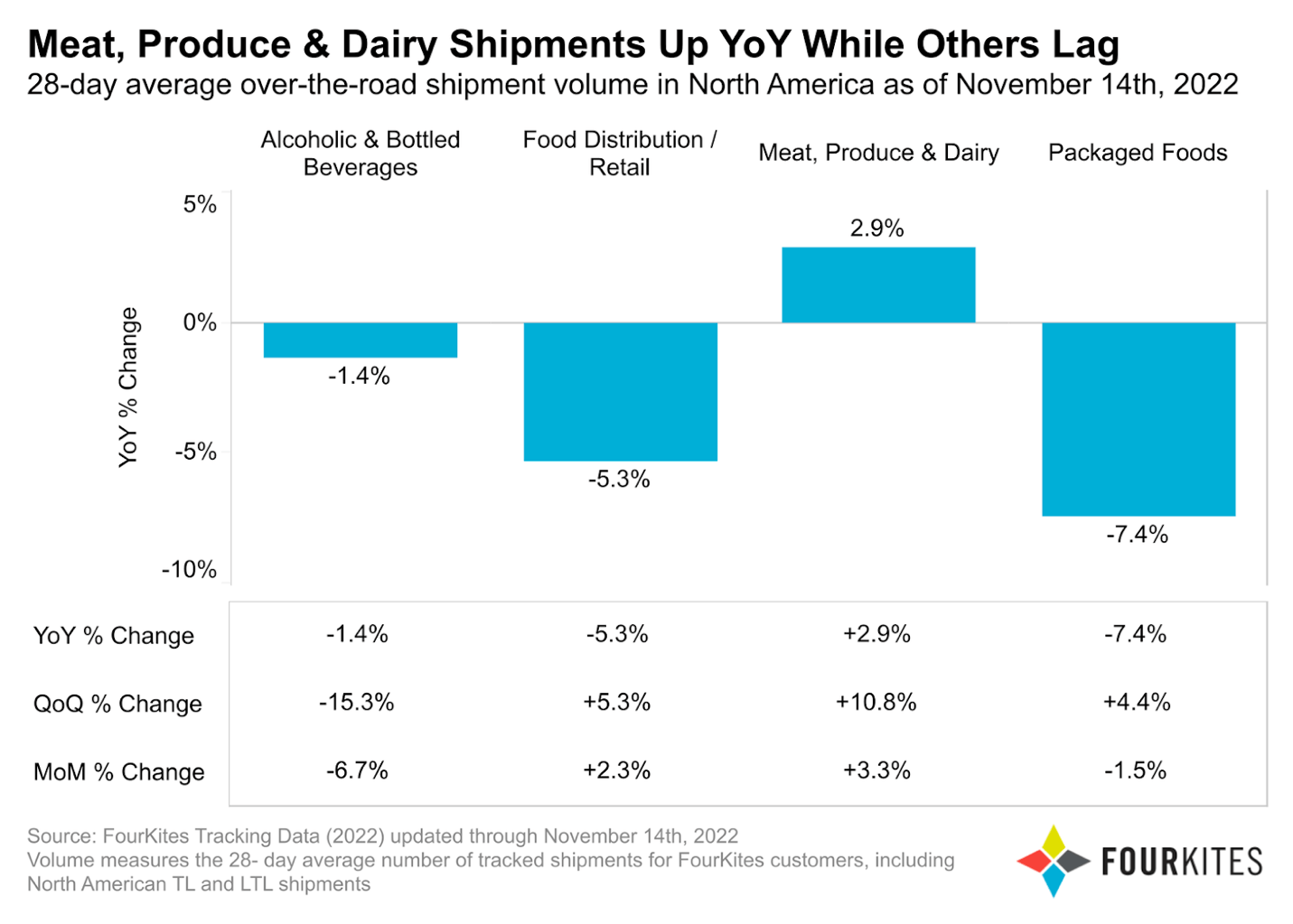

Leading up to Thanksgiving, FourKites has seen strong performance year-over-year within the meat, produce & dairy segment, with the 28-day average over-the-road shipment volume in North America up 2.9% year-over-year, up 10.8% quarter-over-quarter, and up 3.3% month-over-month. Alcoholic & bottled beverages have been performing about even year-over-year, with the 28-day average shipment volume down 1.4%.

The segments performing worse than last year are food distribution/retail and the packaged foods segments, with the 28-day average shipment volume down 5.3% and down 7.4% year-over-year respectively.

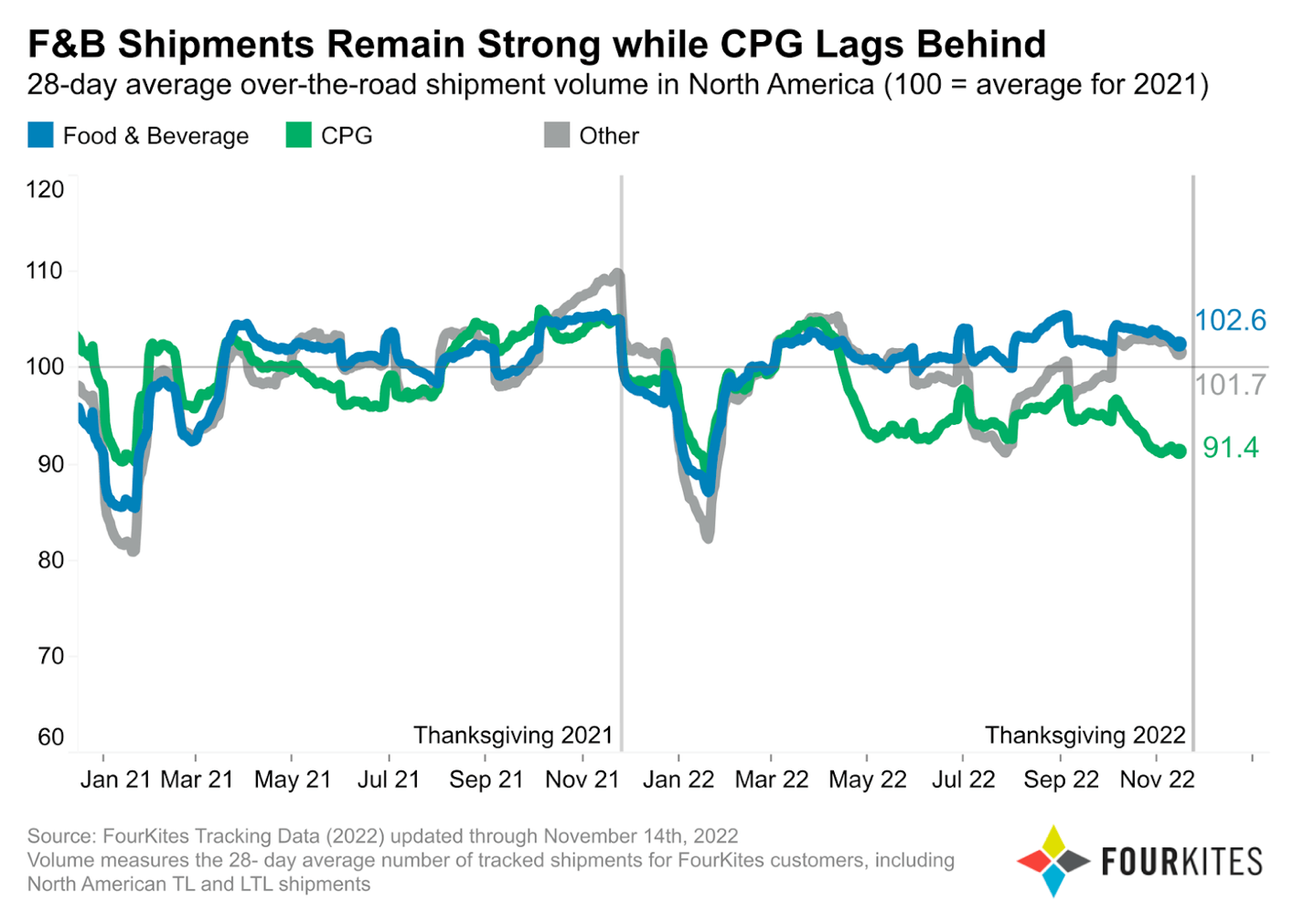

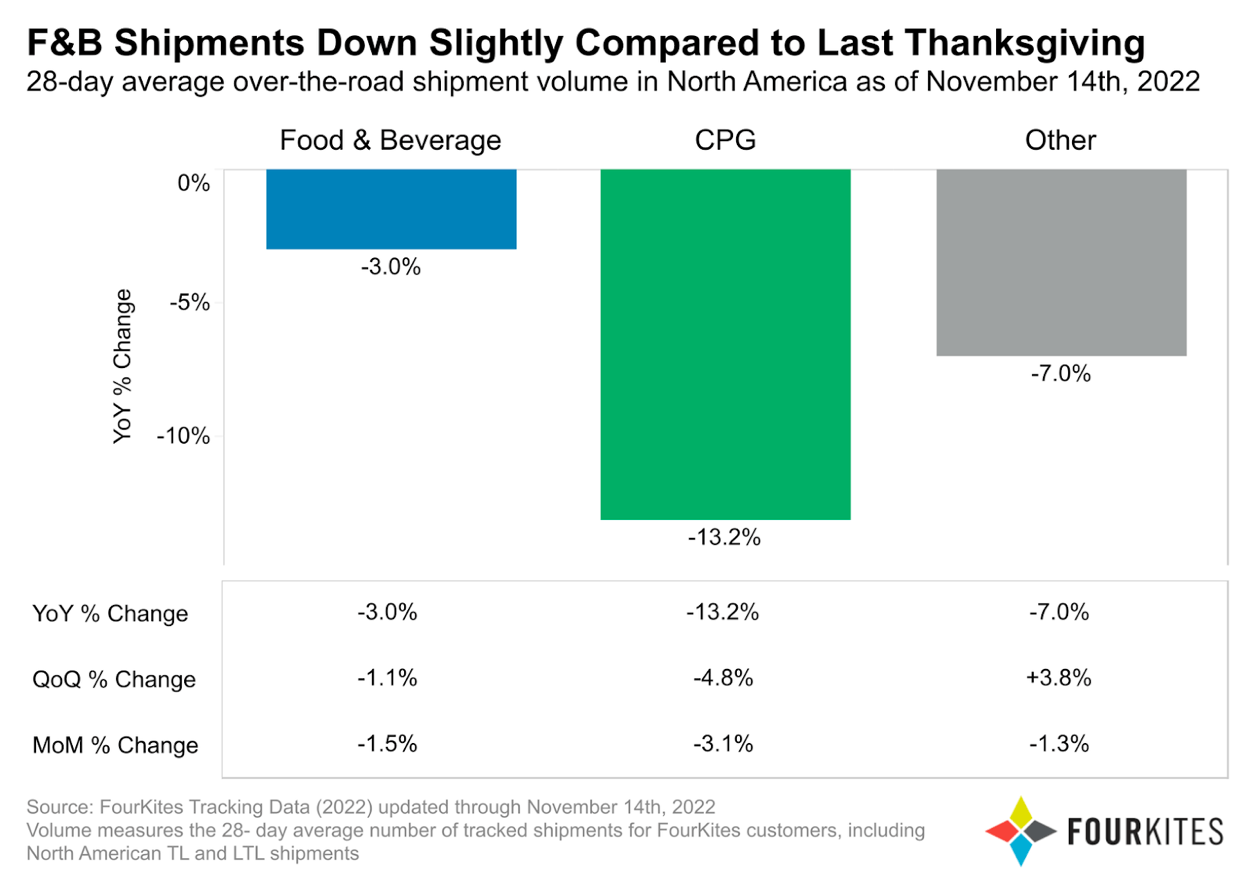

And while food and beverage shipments are down 3% compared to last November, they are still holding steady compared to non-food CPG shipments and other industries.

As the economy continues to cool, we should expect to see a related shift toward more conservative consumer behavior. Holiday hosts might do less of their shopping at high-end grocery stores, choosing instead to stretch their dollar further at discount markets. Demand should also increase for lower-cost or off-brand items. And we should likewise expect to see less traffic at restaurants, including online ordering, paired with more spending on groceries and prepared meals.

Of course, specific shortages are always possible. Food and beverage supply chains are exposed to a wide array of variables, including product recalls, farm output, labor strikes, and weather. And while food and beverage is more insulated from international factors than many other industries, it isn’t immune: for example, producers may need to import certain elements of their final product, like packaging. But all in all, we should expect that any hiccups will be isolated to specific regions, companies, or products, versus the industry as a whole.

As far as the food and beverage industry is concerned, the pandemic is essentially over. The chaos, uncertainty, demand shifts, and labor and logistics challenges that plagued the industry during the COVID era are now in the rear-view mirror.

This is good news for everyone who gathers around the table with loved ones this festive season. It’s looking to be the first time in years when holiday planners and procrastinators alike can breathe a little easier, knowing the shelves should be fully stocked with their family favorites. And for that, we are all thankful.