The supply chain has faced unprecedented pressure in recent weeks as retailers grapple with huge spikes in demand for food and packaged goods. Despite spot shortages that continue to crop up due to panic buying, the US supply chain, in particular, has proven itself capable of meeting surging demand for food and beverage and consumer packaged goods products.

However, our latest analysis of FourKites platform data indicates that facilities are struggling to efficiently process the surge in shipment volumes, resulting in long delays for truckers and other front-line workers at facilities in the US and Europe.

FourKites monitors dozens of conditions that affect transit times over millions of loads. When a shipment is late, FourKites analyzes all of the associated transit data to identify and stack rank various reasons a load may have been delayed. These are data-driven, diagnostic measures that provide much-needed insight into the operational and environmental conditions that cause a load to be late. A load can have multiple reasons for being late, of course, and analyzing these helps us hone in on the condition(s) that drove the biggest delay in shipment time. FourKites is tracking over 10 primary drivers for shipment delays, among them controllable reasons like pickup, external factors like weather, traffic and facility congestion, or macro factors like border congestion.

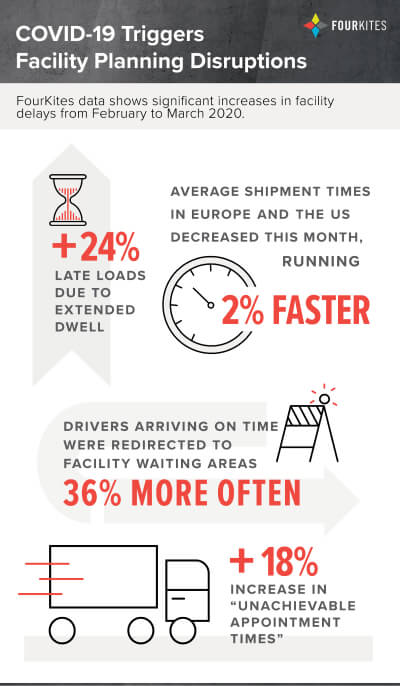

In analyzing our data over the course of February and March, FourKites data shows a significant increase in facility-related delays as the COVID-19 pandemic continues to spur abnormally large shipment volumes. More specifically:

Here is a sample of how we see congestion at a specific facility. The heatmap below highlights the busiest times by hour of day and day of week to give planners and carriers the greatest insights into how to schedule shipments and arrivals.

As you might expect, our analysis also corroborates that goods are moving faster in transit than they were a month ago. Average shipment times ran 2% faster in the US and Europe in March – likely a reflection of decreased traffic on the roads, as well as the recently enacted emergency waiver governing trucking hours of service (HOS) regulations. But the slight improvement in transit times isn’t enough to make up for the significant delays drivers face once they arrive at overburdened facilities.

FourKites analyzes data from millions of loads and real-time machine learning to help shippers and carriers optimize their assets and inventory movements. Stay tuned for additional FourKites insights, as the impact of COVID-19 on global supply chains continues to unfold in the weeks ahead.